In the pursuit of business success, evaluating the soundness of a proposed business model is crucial. But how is a business model evaluated? Let me share the three core tests to ensure a comprehensive assessment of business opportunities.

The Three Core Tests

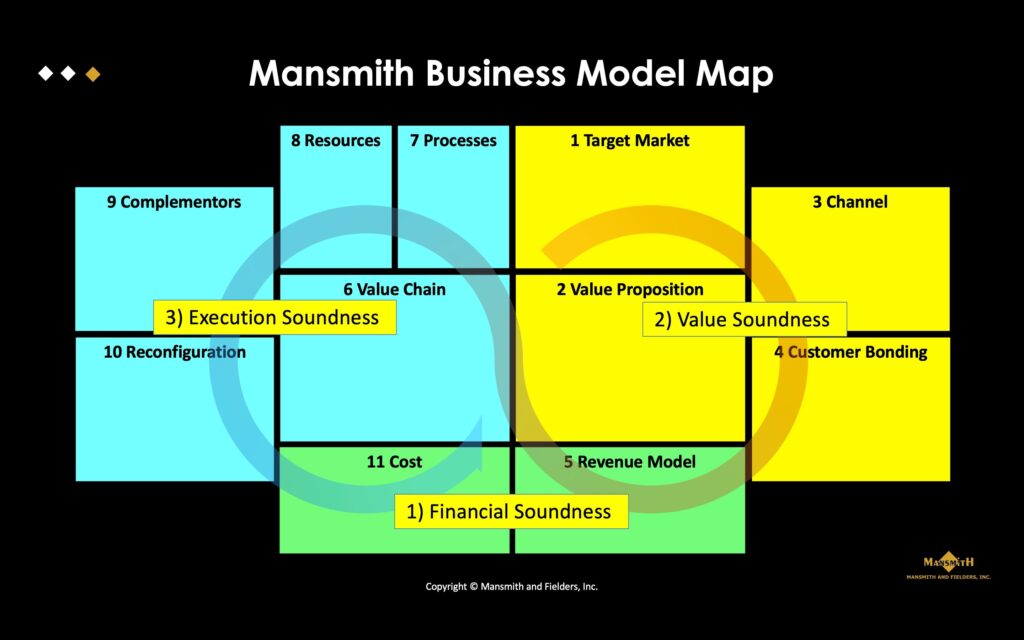

The Mansmith Business Model framework, involving eleven building blocks, recommends three primary core tests to evaluate a business model:

- Financial Soundness Test: This test scrutinizes both the profitability and sustainability of the proposed business model. It delves into revenue streams, cost structures, and the potential for long-term financial success. While profitability focuses on earnings generated from operations, financial soundness assesses the broader financial health and stability of a company.

- Value Soundness Test: The value soundness test focuses on the overall strength and sustainability of the offering model. It is different from a value proposition test, which specifically evaluates the effectiveness and appeal of the value proposition to the target market.

- Operational Soundness Test: This test focuses on efficiency and effectiveness, assessing the ability of the business model to execute its strategy and deliver on its promises to customers without interruption.

Alignment with New Initiative Screening

It’s essential to highlight how the three tests align with the principles of new initiative screening:

- Desirability, mirroring the value soundness test, evaluates if there’s a genuine market need for the proposed initiative. It considers the adaptability of the business model to changing market conditions and emerging trends for sustained relevance and competitiveness.

- Feasibility, similar to operational soundness, examines the technical capability to deliver on the initiative.

- Viability, synonymous with financial soundness, assesses the initiative’s potential for long-term profitability, stability, and growth.

- Scalability, also comparable to financial soundness, ensures that it can efficiently expand and evolve to meet increasing demand and capitalize on new opportunities.

This structured approach enables systematic analysis of business opportunities and identifies areas for refinement and optimization.

Illustrative Example:

Pyramiding, an illegal business model in the direct selling industry, exemplifies why it fails to meet the criteria of the three core soundness tests for evaluating business model soundness:

- Financial Soundness Test: Pyramiding schemes often promise quick and substantial returns by recruiting new members into a network instead of earning commissions on their sales. However, these schemes are inherently unsustainable. As the network grows, the pool of potential recruits diminishes, making it increasingly difficult for existing members to earn profits. Eventually, the pyramid collapses, leading to financial losses for the majority of participants. This failure to generate long-term profitability and financial stability highlights the inadequacy of pyramiding schemes when subjected to the financial soundness test.

- Value Soundness Test: In addition to its financial unsustainability, pyramiding raises ethical concerns regarding its offering model. Participants are often misled into believing that they can achieve financial success simply by recruiting others into the scheme. This deceptive practice undermines trust and integrity in the marketplace. Moreover, regulators and consumer advocacy groups often scrutinize pyramiding schemes for their deceptive and exploitative nature. In many cases, companies operating such schemes are required to amend their compensation plans to comply with legal and ethical standards, further exposing the flaws in their offering model.

- Operational Soundness Test: From an operational perspective, pyramiding schemes face significant challenges in obtaining regulatory approval and maintaining legal compliance. Regulators closely monitor these schemes for signs of illegal pyramid structures or Ponzi schemes, which are prohibited under law. As a result, companies engaged in pyramiding encounter difficulties in obtaining permits or licenses to operate legally. Moreover, the negative publicity associated with pyramiding schemes can undermine their operational credibility and sustainability. Ultimately, the lack of regulatory approval and legal compliance undermines the operational soundness of pyramiding schemes, further highlighting their inherent flaws as a business model.

Pyramiding fails to pass the three core tests for evaluating business model soundness due to its financial unsustainability, ethical concerns regarding its value proposition, offering model, and operational challenges related to regulatory compliance. This example underscores the importance of conducting comprehensive assessments of business models to identify and mitigate potential risks before launching new initiatives.

Evaluating the soundness of a business model requires a multifaceted approach. By aligning with the principles of new initiative screening and incorporating financial, value, and operational soundness tests, businesses can gain a deeper understanding of their potential ventures. This holistic approach empowers them to make informed decisions and pursue strategies that are not only viable but also adaptable and scalable in a dynamic business landscape.

***

Josiah Go is the chair and chief innovation strategist of Mansmith and Fielders Inc., and a previous winner of innovation excellence awards at the 10-country ASEAN Business Awards. Josiah Go offers a 55-video course on business models, accessible 24/7 at www.continuum-education.com. He will be answering live questions about business models on June 24, 2024. Register at www.mansmith.net.