GCash is the dominant mobile wallet in the Philippines, widely used for a variety of services such as money transfers, bill payments, micro-lending, and even investments. In its efforts to expand globally, GCash has partnered with leading financial institutions and platforms such as Alipay and Western Union to facilitate international remittances and cross-border payments. This makes it easier for Filipinos abroad to send money home and pay for international goods and services.

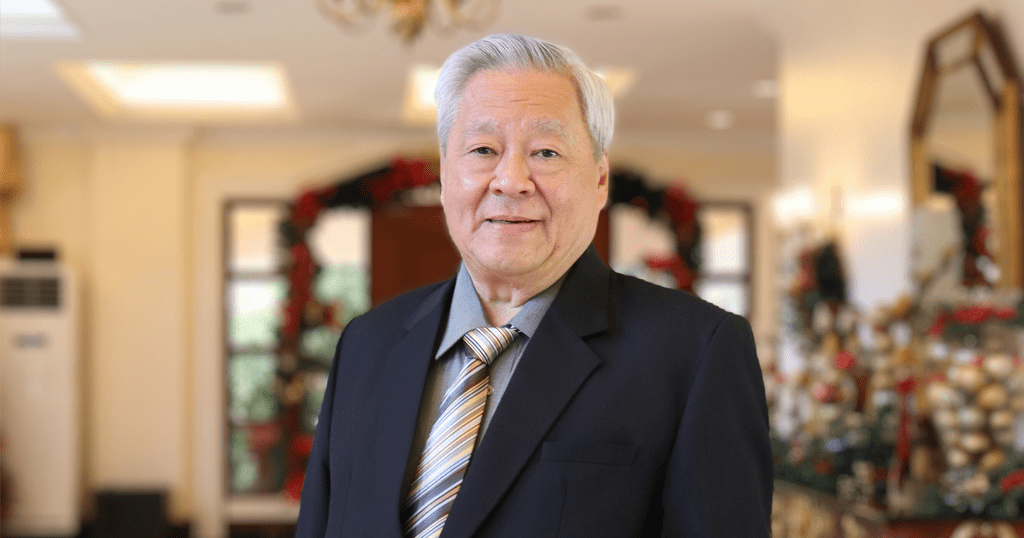

Paul Albano, GCash’s General Manager for International, and a recent recipient of the Mansmith Market Mentors Awards (MMMA) — nominated by his mentee from Procter & Gamble — shares his insights on GCash’s international expansion, his leadership philosophy, and his views on the future of digital payments.

Q1: You’ve had a successful career at P&G, where you were head of sales. How have those experiences shaped your approach to leading GCash’s international expansion?

A1: At GCash, our purpose is Making Filipinos’ Everyday Lives Better. For GCash International, it is all about serving the needs of the ~13 million Filipinos living and working overseas, the ~5 million Filipino freelancers based here but taking on jobs from abroad, and the ~6 million Filipinos travelling overseas per year. We put them at the core of everything we do as we strive to deliver the best possible customer experience to allow them to stay connected to home and be more in control of their finances despite being away from home.

P&G’s focus on winning with consumers, delighting them with a superior product experience end-to-end, and in turn, translating to market growth and leadership, has been a solid foundation for me as I lead GCash International business expansion. Throughout my P&G career, I was fortunate to work on growing established brands and businesses, and fueling whitespace entries both here and abroad. Looking back, these experiences have been helpful for me as we define and refine our business model and strategies for GCash International.

Getting to know our target users in depth – their demographics, their needs, wants and pain points, their habits and behaviors; understanding market and competitive landscape; defining our value proposition and tailorfitting our products and services; and developing the route to market model and strategies to reach, acquire and retain users are critical to GCash International’s expansion and growth.

In 2024, we launched GCash Overseas in 16 countries– where we can account for 80% of the Overseas Filipino diaspora; Filipinos in these countries can now register their international mobile numbers to GCash and get access to GCash’s suite of products and services as if they were back home. We have also since enabled Global Pay for Filipinos travelling overseas, with this Filipinos can now use their GCash app or GCash card to pay for their transactions abroad and enjoy low FX conversion and zero service fees.

Q2: As a recent winner of the 6th Mansmith Market Mentors Awards, you’re clearly a respected leader in the marketing and business community. How do you approach mentoring and building high-performance teams, especially in a fast-growing company like GCash?

A2: GCash attracts and recruits the best talent in the market to support our growth and expansion. Each GCash employee brings skills, experiences and competencies that create and add value to support our purpose, strategies and action plans. Our 7 core values help shape our culture which for me, is the cornerstone of any high performing organization. As the GCash International business and organization grow, creating a high-performance team will continue to be a journey, grounded on collectively building a culture that is rooted on our purpose and values, and individually, on what each team member brings to make our plans and executions bigger and better.

It is on the same note that I anchor my approach to mentoring. Before I agree to mentor someone, I need to be clear on what value I bring to the individual to make him/her better. As such, knowing the mentee is critical – his/her purpose, career and/or personal aspirations, strengths and opportunities, and what he/she would want to achieve out of the mentorship relationship. Since mentorship is a relationship, there has to be a fit between mentor and mentee for it to be productive. It is a commitment that requires time and effort; and is two-way and reciprocal – as a mentor, I seek to learn from my mentees and I am as invested as they are in this partnership.

Q3: GCash is the dominant mobile wallet in the Philippines, but you’re essentially starting from scratch in foreign markets. What are some of the unique challenges you’ve faced in promoting and scaling GCash internationally?

A3: As we expand to serve Filipinos overseas, we anchor on the strengths of GCash here at home: our user penetration with over 94 million Filipinos having used GCash; our ubiquity in the market with over 6 million merchants and social sellers connected to the GCash app; and our strong brand equity – with a best in class net promoter score of 92%, Filipinos trust us for their every day transactions. Leveraging these, though, do not automatically translate to immediate acquisition, adoption and usage for Filipinos overseas as we face challenges across:

1. Brand Awareness. There is a considerable number of Overseas Filipinos, migrants who have been living outside the Philippines for a long period of time, who do not know of GCash or may just have heard of us from their family members back home but do not see a need for it.

2. Regulatory Requirements. As part of our KYC (Know Your Customer) process, we require our customers to show proof that they are Filipino to get their account fully verified. We have noted drop offs at registration due to lack of Philippine IDs, particularly in cases of OFWs whose employers as a practice hold their passports throughout their employment period and dual citizens who have either expired or yet to acquire Philippine passports.

3. Inertia. Mirroring the Philippines, we need to make GCash a part of the Overseas Filipinos daily lives. This will take time and habituation as most overseas Filipinos have existing practices and solutions to manage their finances back home like sending money or paying for their household expenses.

Q4: Overseas Filipino Workers (OFWs) are a key demographic for GCash. From your perspective, who exactly are the OFWs, and what are some key characteristics or behaviors that define this group?

A4: The Overseas Filipino Worker is a primary target segment user for GCash Overseas. About 2 million leave the Philippines every year to work abroad, most of them separated from their families in search of better opportunities for themselves and their loved ones. We take pride that they are recognized worldwide for their skills and commitment to their work. They are considered modern day heroes with their remittances equivalent to 9% of the Philippine GDP, but they remain an underserved segment of our society, with huge opportunities in making their lives easier and better.

The OFW we serve is the construction engineer in the UAE who is also building his own house for his family back home. It’s the care-giver in Italy who takes on extra jobs to send her 3 children to school in elementary, high school and college. It’s the nurse in the US who has invested part of her salary in a condominium unit back home to rent out. It’s the seafarer who takes on overtime not just to keep himself busy and be less homesick, but also to get extra income to pay for his uncle’s hospital bills, apart from his own family’s day to day expenses. And there are many more other OFWs across industries and countries, each with their own purpose that we in GCash International aim to serve with a frictionless experience to allow them to stay connected to home and be more in control of their finances behind the convenience of our app.

With GCash Overseas, OFWs can pay for monthly utilities, school tuition fees, real estate amortization, hospital bills, and many more with over 2,000 billers enrolled in the app. They can also better plan and budget their remittances by sending exact amounts directly to individuals when needed as sending GCash to GCash is real-time, safe and free. They can also open a savings account within the app to save some of their earnings for when their employment contract expires. We aspire to create GCash Overseas stories as we work on our use cases to be a part of the OFW’s lives, and make it easier and better.

Q5: With your expertise in sales, how does GCash approach customer acquisition and retention in international markets?

A5: We approach it the same way it has worked for us here in the Philippines. We are grounded on who our customers are, where they are located, what their needs and pain points are, as well as their current sending habits and behaviors, and how we will be able to make theirs and their families’ everyday lives better.

Our value proposition of connection, control and convenience drives both acquisition and retention behind regular usage. On connection, we leverage the strong organic pull into GCash from their family and friends back home to send money through GCash, and supplement this with on-the-ground in-market campaigns in partnership with Filipino organizations and communities, our Philippine embassies and consulate offices, and Filipino businesses and establishments. On control and convenience, we highlight our hero use cases within the app like paying bills, sending money, savings that the OFW can now do him/herself vs. being reliant on others. In the US, UK and Europe, OFWs can even link their US/UK/EU bank accounts and cash in directly into their GCash wallets, mirroring the same experience back home for ease and convenience of use. Our thrust is to make GCash a part of the overseas Filipino’s everyday life, with our use cases solving their needs and pain points.

Q6: GCash has made significant strides in integrating international features, like enabling cross-border payments and expanding digital financial services. Can you share your experience so far with this global expansion and the challenges or successes you’ve encountered?

A6: Partnerships play a critical role in GCash International’s growth and expansion plan. Being connected to multiple global payments and transfers networks is key to enable GCash access and usage anywhere in the world. On the cross-border payments field, we partner with both AliPay and Visa to allow outbound travelling Filipinos to use their GCash app or GCash card to pay for their transactions in 200+ countries and territories around the world with the lowest FX rates and zero service fees, freeing them from the hassle of carrying cash and exchanging currencies whilst travelling.

We are also connected with leading international payment platforms like PayPal and Payoneer that allow freelancers to receive payments from their foreign clients straight into their GCash account real-time and with minimal transaction fees. On the cross-border transfers side, we partner with global and in-country money transfer operators, both over the counter and digital, to enable inbound remittances and cash-in to GCash wallets.

As we expand globally, we are well aware that regulations by country may differ and we go the extra mile to ensure we are compliant. And as we target Overseas Filipinos, building the infrastructure and ecosystem to best reach them are also critical to our success. Working with our embassies and consulates, and engaging with overseas Filipino communities and establishments are important in establishing awareness, acquisition and usage. Like any start up, challenges abound but we take inspiration on how our Global payment solutions are making an impact for Filipinos through word of mouth and organic content in social media.

Q7: Given your experience working with emerging markets, what do you see as the future of digital payments in Southeast Asia and other developing regions? What role do mobile wallets like GCash play in that evolution?

A7: Southeast Asia and most developing regions have a young population that are technologically savvy, this is characterized by high smartphone penetration and daily online activity. Moreso, with online and e-commerce transactions continuing to gain traction with critical mass, coupled with more liberalized cross border trade, cross border payments are expected to follow. However, these same regions, face significant challenges with financial inclusion, as a large portion of the population remains unserved or underserved by traditional financial institutions. This presents a compelling opportunity for e-wallets and finance superapps to break down barriers, empower individuals with meaningful digital services, and drive financial inclusion. As such, regulatory advancement– centered around financial inclusion, interoperability and seamless integration of financial services into everyday life– is critical.

At GCash, in line with our vision of “Finance for All”, we work closely with the government in driving financial inclusion by giving Filipinos access to and democratizing financial services to improve their overall financial well-being. In the cross border space, we partner with regulators and governments, as well as the private sector to enable ease of transactions behind connectivity and interoperability, while ensuring regulatory compliance and safety and security as base standard.

Q8: As someone who has been recognized for both leadership and market expertise, what advice would you give to aspiring leaders looking to make an impact in international markets?

A8: Be clear on the business/organization challenge and the value you bring to the table. Be real to yourself – play to your strengths but never be blindsided by your development areas. Anchor your skill set, capabilities and experience to the challenges that lie ahead.

Invest time to get to know your customers and their culture in depth – demographics, needs, wants and pain points, habits and behaviors. Understand your product and competition – define your value proposition, right to win and superiority. Craft the business model and route to market, most times, it will be a variation of what you are used to in your home country. And build and retain your organization to deliver exceptional execution by enabling them and recognizing them for their results and growth.

***

Want to gain more insights from Paul Albano? The 16th annual Mansmith Market Masters Conference, featuring top CEOs, legendary founders, leading innovators, turnaround specialists, and top mentors, is scheduled for March 11, 2025, at SMX Aura. Visit www.marketmastersconference.com for details.

***

Josiah Go is the chairman and chief innovation strategist of Mansmith and Fielders Inc.