During two visits to Taipei in 2025, I noticed a seemingly small, everyday action: handing over a credit card to a server that reflected something much larger: how trust shapes both business and society.

With decades of studying market trends and consumer behavior, I’ve seen firsthand how trust influences business interactions. This article reflects those insights, particularly in Taipei and Manila, where cultural nuances deeply shape how transactions unfold.

In Taipei, it’s common practice for customers to hand their credit card to a server, who then walks away to process the payment. There’s no alarm, no suspicion. The transaction is seamless. In Manila, by contrast, the terminal is always brought to the customer, who swipes or taps the card personally, an action that seems minor but has bigger implications.

This observation goes beyond payment protocol; it mirrors the culture, trust dynamics, and risk tolerance of each society, as well as how businesses adapt to meet consumer expectations. What I saw was more than just habit; it was a reflection of deeper insights into how business operates in different contexts.

Taipei: Where High Trust Enables High Convenience

Taiwan is a high-trust society, and it shows. Consumers feel secure in public and commercial transactions. Whether they’re handing over their credit card, leaving personal belongings on a café table, or expecting honest change from a street vendor, trust is baked into everyday interactions.

During both of my visits, I observed:

- Strong Institutional Trust – Consumers believe that businesses, banks, and employees will do the right thing. There’s little fear of card skimming or unauthorized charges. The assumption is: “The system works.”

- Service Efficiency – High-trust environments often allow for greater speed and flow in service. Since customers don’t require extra layers of verification or oversight, service staff can move quickly and confidently.

- Cultural Values – Taiwanese society places a premium on harmony, responsibility, and collective good. There’s an underlying belief that trustworthiness is the norm, not the exception.

This makes Taipei’s business culture particularly smooth. When trust is strong, businesses can focus more on optimizing customer convenience, knowing that customers aren’t constantly on the defensive.

Manila: A Culture of Vigilance and Control

By contrast, Manila represents a more cautious, moderate-trust society, especially in transactional contexts. The expectation is that the customer stays in control of the process. You don’t let your card out of your sight. The terminal comes to you. This reflects:

- Higher Risk Sensitivity – Due to past or ongoing issues with fraud and scams, customers and businesses alike err on the side of caution. This isn’t paranoia, it’s a response to real experiences that shape consumer behavior.

- Personal Responsibility and Control – Filipino consumers are often hands-on when it comes to money. The habit of watching the transaction happen is part of a broader mindset that says, “It’s my job to protect myself.”

- Security-Focused Service Design – In contrast to Taipei’s convenience-first model, Manila’s service flow includes built-in checks that reassure the customer their transaction is safe.

Here, businesses win trust not by speed or ease, but by showing that security is a priority. That kind of risk management is what drives customer satisfaction in moderate-trust environments.

More Than Culture: What This Tells Us About Society and Business

At a deeper level, this contrast is not just about payment behavior, it’s a reflection of societal psychology, shaped by history, economics, and institutional maturity.

- Trust is both a social and economic resource. High-trust societies reduce friction in commerce, increase efficiency, and enable businesses to innovate faster in customer experience.

- Risk perception drives consumer behavior. In lower-trust or high-risk societies, businesses must work harder to reassure customers, not just through messaging, but through operational design.

- Technology alone isn’t enough. Both cities have access to the same payment technology. But the way they implement it reflects the soft infrastructure: trust, norms, values, that drives real-world behavior.

- Service design must align with local expectations. You can’t simply import a customer experience model from one country to another. Trust levels, cultural expectations, and behavioral norms must be understood before designing processes or introducing change.

Business Implications: Know the Trust Level, Design Accordingly

Whether you’re a local entrepreneur or a multinational entering new markets, understanding the local trust dynamics is not optional, it’s essential.

- In high-trust markets like Taipei, design your services around speed, convenience, and autonomy. Customers don’t need as much reassurance, they want seamless experiences.

- In moderate- to low-trust markets like Manila, build in visible security cues. Let customers stay in control. Reassurance is part of the service value.

The same technology, in this case, credit card terminals, is perceived and used differently based on these social dynamics. And that has direct impact on customer satisfaction, operational design, and brand perception.

Trust Is the Invisible Infrastructure

What I witnessed in Taipei and Manila is a reminder that trust is the invisible infrastructure that shapes how economies work. You may not see it, but you feel it, in how payments are made, how staff are trained, and how customers behave.

These are not just operational differences. They are reflections of a society’s values, a consumer’s lived experience, and a business’s understanding of its market.

On the surface, handing over a credit card or holding onto it may seem trivial. But underneath, it tells the story of culture, caution, confidence, and ultimately, how businesses must adapt to earn and keep trust.

On my next trip to Taipei, I’ll be watching closely to see how these practices continue to evolve and what other lessons they might offer. But one thing’s for sure: trust is at the heart of every transaction, and it shapes the way customers experience and engage with businesses.

***

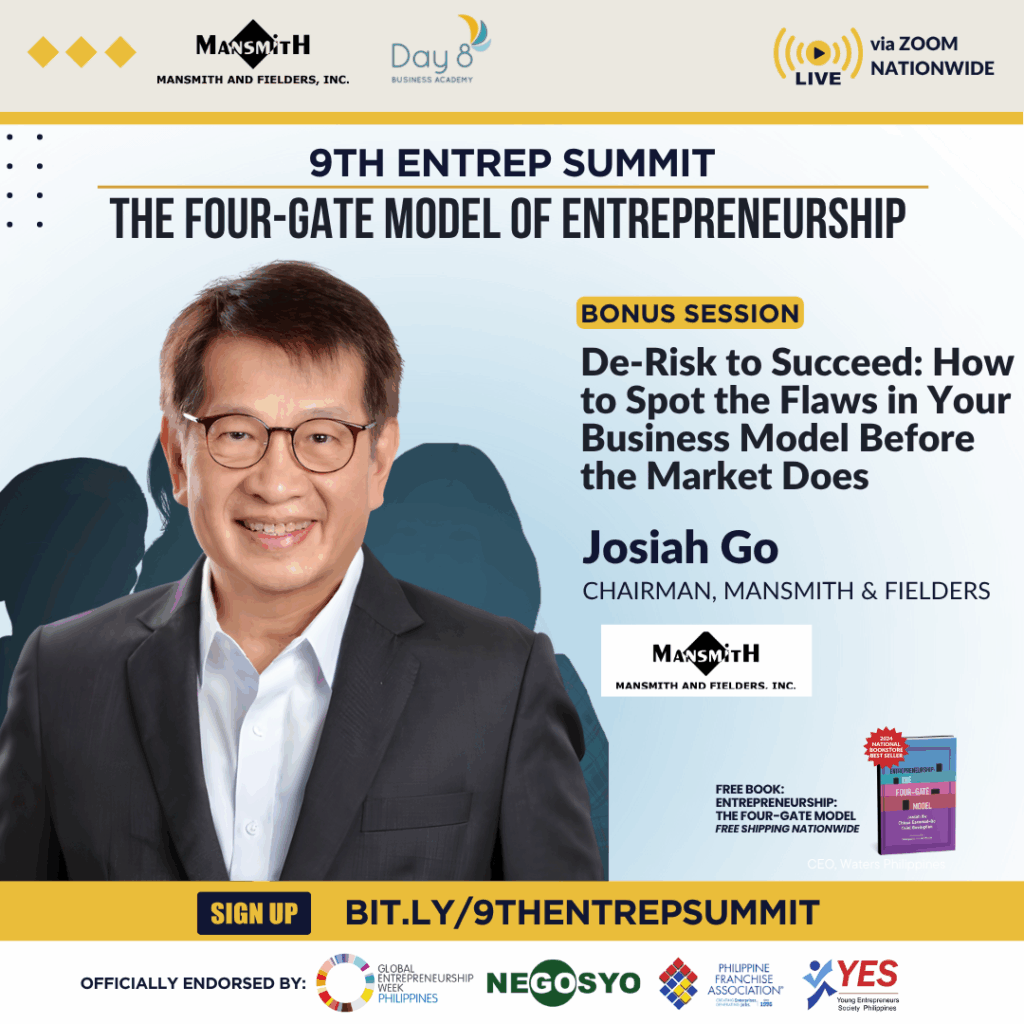

Josiah Go is the Chair and Chief Innovation Strategist of Mansmith and Fielders Inc. He will be speaking on ‘De-risking Business Models’ at the 9th Mansmith Entrepreneur Summit on November 8, 2025