Imagine your leadership team sailing smoothly through calm waters, until an unexpected iceberg strikes. The forecasts were solid. The numbers were sound. Yet beneath the surface, something far more insidious was at play: distorted risk perception. That iceberg? Cognitive bias: sharp, hidden, and often unseen until it’s too late.

Organizations rarely fail because of risks they saw coming. More often, they falter over those they misjudged. When understood and managed properly, risk can fuel innovation, sharpen competitive advantage, and unlock growth. However, when misunderstood or ignored, it drains resources, delays decisions, and paralyzes execution.

By the time the damage appears on the P&L, the real cost has already been paid.

The Real Risk Isn’t the Market. It’s Misperception.

We typically define risk by external forces: competition, geopolitical shifts, supply chain disruptions. However, the deeper, more subtle danger often lies within, in how leaders perceive those risks.

Risk perception is not just a cognitive process. It is emotional, cultural, and systemic. It shapes strategy, budgets, team behavior, and morale. Yet, unlike financials or forecasts, it’s hardly scrutinized with the same intensity.

Distortion doesn’t always stem from bad data. It arises from how we interpret that data, through mental shortcuts, internal narratives, and deeply ingrained habits. These biases create a false sense of certainty, where confident teams march toward failure they could have prevented.

That’s why modern leadership isn’t just about managing risk; it’s about managing the distortion around risk.

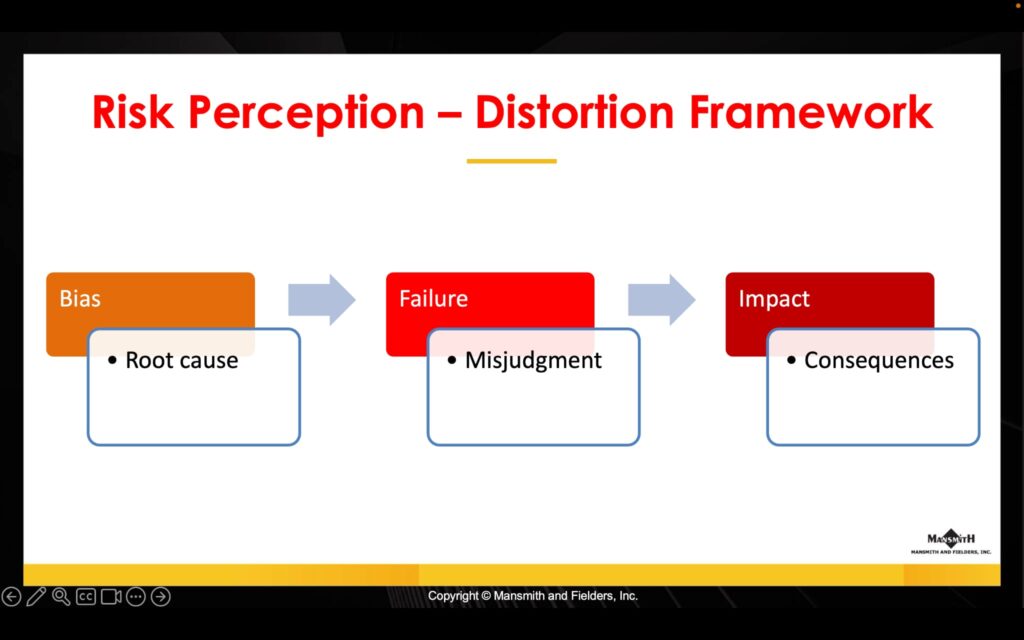

The Risk Perception–Distortion Framework

To address this challenge, I use a straightforward yet insightful framework:

Bias → Failure → Impact

Misjudged risk rarely starts with bad luck. It starts with how we think. This model breaks the cycle into three interconnected stages:

- Bias – How flawed perceptions begin.

- Failure – How those flawed perceptions lead to poor decisions.

- Impact – How these decisions result in real business losses.

Consider a company with a high risk appetite and overconfidence in its sales forecasts. This bias may lead them to ignore early warning signs from customers. The result? Over-investment in a product that ultimately fails. This sequence of events highlights why mastering this risk framework is fundamental to sound business strategy.

Let’s explore each stage, and how you can guide your team through them.

Bias: The Root Cause

Biases are mental shortcuts. They help us act quickly but can also blind us to critical details. In business, they shape how we interpret data, judge people, and make decisions.

Some common culprits include availability bias, overconfidence, anchoring, confirmation bias, and the sunk cost fallacy.

However, bias doesn’t only reside in individuals, it thrives in teams and organizational cultures. Groupthink, fear of dissent, and legacy thinking all distort how teams perceive risk.

What to Do?

Bias can’t be entirely eliminated, but it can be surfaced and managed. Use strategies like red teaming, bias checklists, diverse inputs, and create a culture of psychological safety. Encourage challenging assumptions and tackle the B.I.A.S. Effect, a diagnostic framework for identifying four systemic forces that reinforce bias in organizations: addressing Behaviors shaped by bias, Incentives that prioritize short-term wins over long-term gain, unquestioned Authority, and Silos that stifle alternative viewpoints.

When these factors align, they reinforce one another, blinding teams to real risks.

Failure: The Misjudgment

Identifying the risk is only the first step. Many failures occur even when risks are spotted, because execution falls into familiar traps.

Execution failure is sometimes even rewarded in the short-term. Speed is mistaken for clarity. Agreement is confused with alignment.

Common failure patterns include action bias, planning fallacy, single-scenario thinking, base rate fallacy, and escalation of commitment.

These mistakes aren’t just accidents; they can be deeply embedded in corporate culture. A team that values rapid action over careful consideration may continuously make quick but poorly judged decisions.

What to Do?

Implement stage gates, stress testing, and devil’s advocacy. Use pre-mortems and pause protocols to ensure strategic execution. Avoid execution failure by recognizing the F.A.I.L. Pattern, a diagnostic framework for recognizing common causes of execution failure in strategic initiatives: Flawed assumptions (no validation of current assumptions), Actions without strategy (agreeing without clarity of potential implications), Influence traps (where dominant logic overrides facts), and Leadership gaps (silence in the face of red flags).

Smart execution isn’t about moving slower, it’s about moving with shared clarity and strategic awareness.

Impact: The Consequences

When bias and execution failure compound, the real costs reveal themselves, not just in profits, but in momentum, morale, and missed growth opportunities.

Impact consequences include Investment losses, Missed opportunities, Paralysis, Alignment loss, Customer distrust, and Toll on resources.

And don’t forget: most impacts are lagging. By the time the damage becomes visible, the distortion may have been brewing for months or even years.

What to Do?

Use scenario planning, diversify risks, apply risk-adjusted thinking, set up early-warning systems, and conduct post-mortems to detect risks early and course-correct as needed.

Also, keep in mind that risk perception is co-created. It’s not just internal: customers, regulators, and even competitors form judgments about your choices. Your team’s clarity becomes their confidence.

The Core Chain:

Bias → Failure → Impact

If your team doesn’t share a clear, evolving understanding of risk, even the best strategy is vulnerable. Leaders don’t need to be perfect forecasters, but they must be distortion-aware. Because the real task isn’t predicting the future; it’s helping your team see the present clearly enough to act wisely.

How to Apply This in Your Next Meeting

Here’s a 5-point clarity checklist for your next strategy or planning session:

- Run a Bias Audit – Are we anchored on outdated assumptions? Are we avoiding dissent? Overconfident?

- Spot Failure Triggers – Are we moving quickly for the right reasons, or just reacting?

- Trace Risks to Real Impact – What misjudged assumptions are already costing us time or trust?

- Embed Thinking Safeguards – Use pre-mortems, red teams, and structured debates.

- Promote a Culture of Clarity – Reward honest questions, normalize course correction, and welcome thoughtful dissent.

Clarity Drives the Future of Value Creation

Clear thinking eliminates distortion. It fosters alignment. It transforms risk into opportunity.

The greatest threat isn’t volatility or complexity, it’s how we perceive them. Risk management isn’t a department; it’s a culture, a discipline, and a mindset.

When you change how your team sees risk, you change how they make decisions. And when decisions improve, so does everything else.

***

Josiah Go is the Chair and Chief Innovation Strategist of Mansmith and Fielders, Inc. The search for the 5th Mansmith Innovation Awards is ongoing. He will also lead a session on uncovering hidden demand at the 2nd Annual Marketing Plan Nationwide Webinar on September 23–24, 2025. For inquiries, email info@mansmith.net.